News

Directorship opportunities across the listed space - AICD Gender Diversity Quarterly Report Volume 9 26

Don’t promote boardroom diversity because it’s the “right” thing to do. Do it because it will better your business.

It staggers me that in this day and age when so much is known about the benefits of having a diverse boardroom, one that does not solely consist of male senior statesmen, that so many persist with this model.

And when I speak of diversity, I don’t just mean in terms of female representation – though this is incredibly important – I am including diversity in cultural background, age and skills set.

Interestingly, it may be companies in the ASX 200 to 500, or those in the not-for-profit sector, that are taking this advice most readily.

Heith Mackay-Cruise, who sits on the boards of Literacy Planet, Bailador Technology Investments, Lifehealthcare, HiPages, ACG Education and Vision Australia, is a passionate believer in diversity of all types.

“I’m often surprised by the continued dialogue on gender diversity,” Mackay-Cruise says. “My view is that equality of gender and gender pay is a no-brainer and anyone not complying in this day and age shouldn’t be in business.”

Gender however, is just one part of the puzzle.

“As the conversation starts to move to ethnicity, age and cognitive thinking diversity – true diversity ‒ then that is where the board discussions and debates can be the most compelling,” Mackay-Cruise says.

Often it is companies outside the ASX 200 that are more willing to give first-time directors a chance, a factor that often leads to greater skills diversity on their boards.

Ian Cornell, Chair of Baby Bunting, believes these smaller firms are often looking for directors with recent experience as executives.

“These people can offer fresh perspectives to the executive team who are genuinely looking for constructive input and vigorous discussion,” says Cornell, who also sits on the board of Myer and William Inglis.

Baby Bunting is a case in point. When the retailer of everything from prams to nappies was preparing for its initial public offering in 2015, the company rejigged its board. It now consists of four men, including Cornell, Gary Levin, Stephen Roche, the chief executive officer Matt Spencer and two women with significant experience in the retail sector.

“With a relatively new board coming together in this way, a balance and norm are still developing and I think that this helps in generating a positive and energised boardroom,” Cornell says.

For the two new female board members, Baby Bunting was their first directorship. Donna Player previously held a senior executive role at David Jones and Melanie Wilson was Big W’s Head of Online.

When you take a step back, it’s hard to see why these two women, with their wealth of hands-on experience, weren’t snapped up earlier. Both have subsequently taken on additional board roles.

Player is considered one of the country’s heaviest hitters in the retail sector and Wilson has plenty of retail experience, especially in what is becoming the most important space of all, technology.

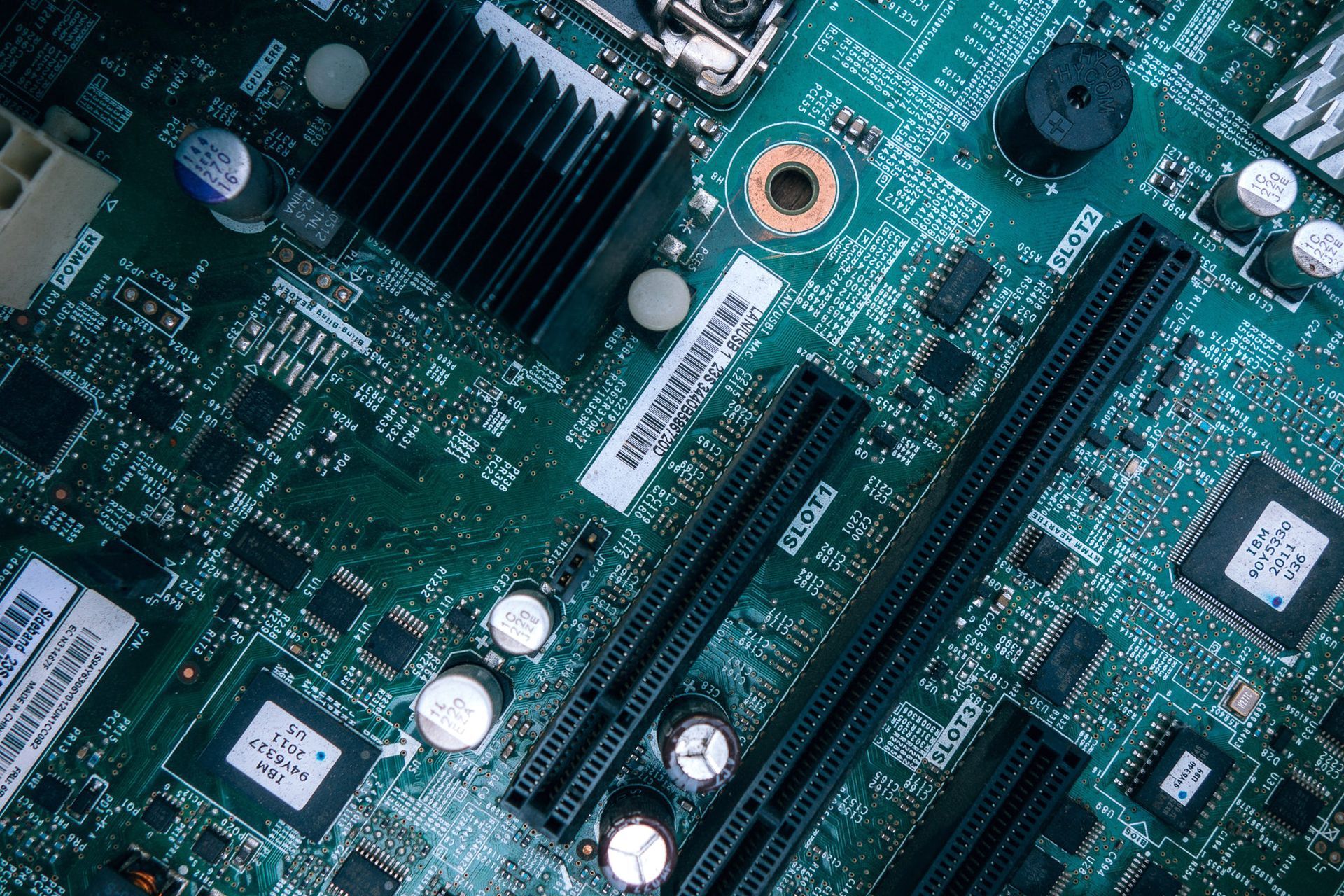

Hands-on experience in technology should be a critical part of any conversation about board renewal in today’s economy.

Just look at the looming arrival of Amazon.com in Australia, and the corresponding fears of slumping bricks and mortar retail sales to understand this point.

This begs the question, how can a board today discharge its corporate governance obligations without having at least one member who has first-hand knowledge of the disruptive forces of technological change?

Jeremy Samuel, Managing Director of private equity firm Anacacia Capital, certainly believes it’s critical. He too is a big believer in diversity of gender, age and experience.

“Having a diverse board is important,” Samuel says. “Investing in both private and public SMEs, we find that companies get to a certain stage and then really benefit from different perspectives from non-executive directors.”

Samuel cites artificial intelligence and machine learning company, Appen, as an example of success through boardroom diversity.

“Appen’s market valuation is now more than 50 times the value when Anacacia first invested and their board diversity has also expanded in step,” Samuel says.

Appen used Derwent Executive to help bolster its board and make it more diverse. Appen was founded by Dr Julie Vonwiller and the board now includes two female non-executives and three male non-executives, with a broad background and skill set.

“I always appreciated having a mixture of gender, ages, experiences, countries, education levels coming together at Appen to help the CEO and management team develop and implement what has been a very successful strategy,” says Samuel, a former Appen board member himself.

The final major piece in the diversity puzzle relates to culture.

Former executive at Pacific Dunlop, Just Group and IBM Consulting, Wai Tang, says companies looking for offshore growth should be considering board members with exactly that diversity of cultural experience.

“As Australian businesses actively invest and seek growth into other markets such as Asia, it is vital for nomination committee to consider cultural diversity when it comes to deciding board composition,” says Tang.

Now an active non-executive director, Tang says there are many young talented executives of Asian background waiting in the wings to be groomed for board room roles. The ASX 200 - 500 market may be the best place for them to start searching.

“Non-executive directors with different cultural backgrounds can add significant value to the business by way of sharing their insights and experience of doing business in Asia,” she says.

Not only are smaller, younger companies often more willing to give different ages, backgrounds and skill sets a chance in the board room, it might also be easier for them to lock in these positions.

“They are often more agile and flexible in nature, versus the quite formal status of larger boards where renewal takes place in a slower and systematic basis,” says Baby Bunting’s Cornell.

The message is clear. If you are an executive with a fresh set of experiences, companies beyond the ASX 200 might be more willing to give you your first directorship. They might want you to be seen AND heard.

Michelle Gardiner, Partner - Board Practice 'Mid size enterprise - in particular firms in the ASX 200 - 500 require high impact talent to succeed. The calibre and diversity of the Board often defines this success.'

The full report can be found here: http://aicd.companydirectors.com.au/advocacy/board-diversity/progress-towards- achieving-30-per-cent-female-representation-across-asx-200-boards-has-stalled

Share this article

Recent Articles